Demystifying Leasing Tax: What You Need to Know

Understanding Leasing Tax is Crucial for Financial Decision-Making

Leasing has become a popular option for individuals and businesses looking to acquire assets without the hefty upfront costs associated with purchasing. However, navigating the world of leasing tax can be a complex endeavor. The intricacies of different types of taxes and their implications can lead to confusion, but having a clear understanding of leasing tax is essential for making informed financial decisions. In this blog post, we’ll delve into the basics of leasing tax, the key differences between sales tax and use tax, factors that influence leasing tax, how to calculate it, and strategies for minimizing tax liabilities.

1. Understanding Leasing Tax Basics:

Leasing Tax Unveiled

Leasing tax refers to the taxes that are applied to leased assets, such as real estate, vehicles, and equipment. Whether you’re an individual leasing a car or a business leasing office space, understanding the tax implications is crucial for budgeting and financial planning. Leasing tax encompasses various types of taxes, including sales tax, use tax, and property tax.

2. Sales Tax vs. Use Tax:

Distinguishing Between Sales Tax and Use Tax

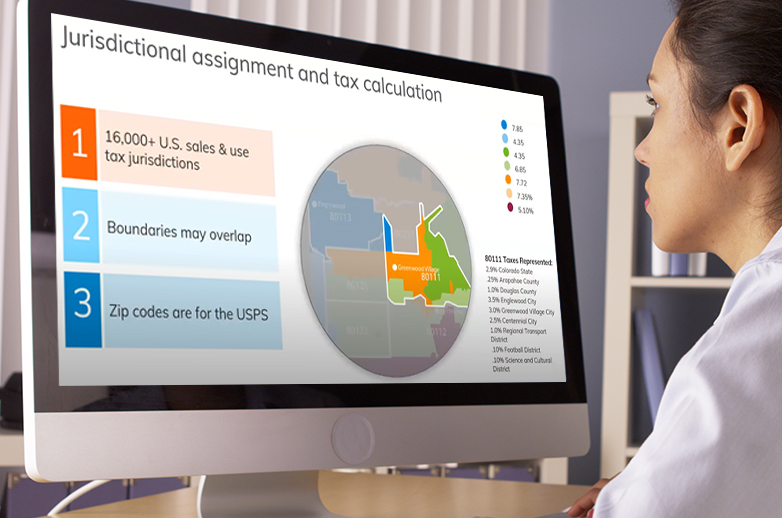

Sales tax is applied at the point of sale and varies depending on the jurisdiction. When leasing an asset, the lessee may be required to pay sales tax on the total lease amount upfront or on a monthly basis. Use tax, on the other hand, comes into play when an asset is used in a different jurisdiction than where it was purchased. This is especially relevant for businesses operating across state or national borders.

3. Factors Affecting Leasing Tax:

Variables That Influence Leasing Tax

Leasing tax isn’t a one-size-fits-all concept. Several factors can impact how leasing tax is calculated. Geographical location is a major consideration, as tax regulations differ from one place to another. The duration of the lease matters too; short-term and long-term leases might be subject to different tax rates. Additionally, the type of asset being leased, whether real property or personal property, can affect how it’s taxed.

4. Calculating Leasing Tax:

Crunching the Numbers on Leasing Tax

The calculation of leasing tax varies depending on the jurisdiction and the specific regulations in place. In most cases, it involves applying the relevant tax rate to the total lease amount. For example, if you’re leasing a vehicle with a total lease value of $20,000 and the sales tax rate is 8%, the leasing tax would amount to $1,600.

5. Tax Implications for Businesses:

Navigating Leasing Tax as a Business

Businesses must be especially attentive to leasing tax implications. Leasing can offer tax advantages, such as deducting leasing expenses as business expenses. However, the tax landscape is complex, and careful planning is essential to ensure that the benefits outweigh the costs. Comparing the tax implications of leasing to those of purchasing is a prudent step for business owners.

6. Recent Changes and Updates in Leasing Tax:

Staying Up-to-Date with Leasing Tax Laws

Leasing tax laws are not static and can undergo changes. Recent legislative updates might impact how leasing tax is applied. Staying informed about these changes is crucial for accurate financial planning and compliance with tax regulations.

7. Tips for Minimizing Leasing Tax Liability:

Strategies for Reducing Leasing Tax Burden

Minimizing leasing tax liability requires a proactive approach. Maintaining meticulous records of lease agreements, expenses, and relevant documents is vital. Exploring tax-efficient leasing strategies, such as structuring leases to align with tax benefits, can also help reduce your overall tax burden.

8. Seeking Professional Advice:

The Value of Expert Guidance

Given the complexity of leasing tax and the potential financial implications, seeking advice from tax professionals or experts is highly recommended. Their insights can provide tailored guidance based on your unique circumstances, ensuring that you make the most informed decisions.

Takeaway

Unlocking the Mysteries of Leasing Tax

Leasing tax may seem like a labyrinth of regulations and calculations, but with a solid understanding of the basics, you can navigate it with confidence. By grasping the differences between sales tax and use tax, considering various factors that influence leasing tax, and staying informed about updates, you’ll be better equipped to make financially sound leasing decisions. Remember that seeking expert advice and implementing tax-efficient strategies can go a long way in reducing your leasing tax liabilities. Armed with this knowledge, you can step into the world of leasing with clarity and financial prudence.